Vietnam wood pellet production and exports

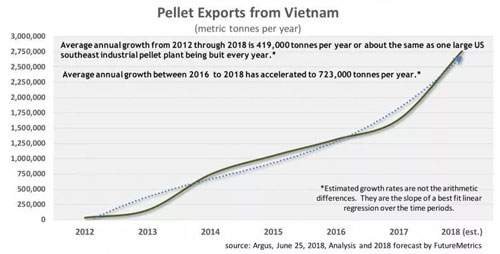

In the past 7 years, Vietnam wood pellet export grows from zero to around 2.75 million tons every year, with most to Korea and Japan. But as the price advantage diminish, will it continue to grow? What’s the trend of Vietnam wood pellet industry?

John Swan, an operation expert who has been directing the design and equipment selection for new pellet plants in Vietnam, analyzed the current situation and future trend of Vietnam wood pellet export.

Vietnam wood pellet production benefits from low cost

Wood pellets in Vietnam are mainly made of the by-products of furniture manufacturing. These sawdust has low moisture content and small size. So many early wood pellet factories don’t need drying or crushing machines. With low labor cost, they can save a great deal of production cost.

For a long time, there are a large number of container cargos shipped from Korea to Vietnam and only small quantities from Vietnam to Korea. Wood pellet manufacturers can make use of the excess empty container for shipment at low cost. The transportation cost is lower than $10 per ton.

Vietnam wood pellet production cost will rise

The shipping cost is going to rise. The rapid growth of cargos from Vietnam to Korea reduce the excess containers. The shipping cost will rise to $20/ton from Vietnam to Japan.

The raw material cost is going to rise. The furniture manufacture in Vietnam increase from 2.1 million tons to 7.2 million tons in the past 10 years, with the annual growth rate of 13%. By contrast, the wood pellet export increases from 160,000 to 2.46 million tons, with the annual growth rate of 61%. So the demand for furniture processing waste growth much higher than the supply.

To expand production, Vietnam manufacturers will increasingly rely on forest residuals and logs. These materials cost higher and need peeling, chipping, crushing and drying for making pellets. So the marginal cost will rise up.

Vietnam wood pellet export price will increase

Most of Vietnam’s wood pellets are exported to Korea and Japan.

In the chart below, the green line shows the weighted price of the top 6 wood pellet suppliers to Korea, and the red line shows the price of Vietnam wood pellets. As Vietnam domains the Korea wood pellet market, other 5 suppliers only take up less than 20% market share. We can find that the growth of Vietnam wood pellet price pushes up the average weighted price.

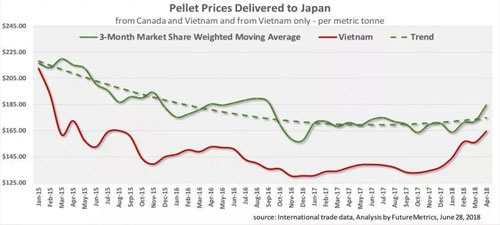

Japan wood pellet market also reflect the rise of Vietnam wood pellet price. Most of Japan’s wood pellets are imported from Canada and Vietnam, with Canada taking up 65%-70%. The green line shows the weighted price of Canada and Vietnam wood pellet export. The red line shows Vietnam’s wood pellet export price rebound.

The growth of Vietnam wood pellet industry is limited

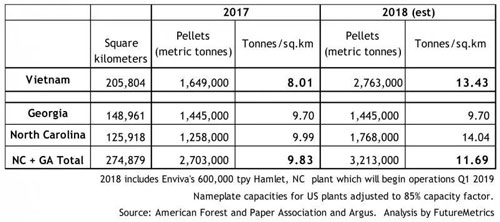

We can analyze the growth potential based on the production intensity of a certain area. It refers to the total wood pellet production divided by the production area. The production area doesn’t includes the land that is not forested or is not available for tree harvesting.

According to statistics, Vietnam wood pellet production grows rapidly, with the production intensity from 8ton/squre km to 13.4ton/squre km. It has exceed the largest wood pellet production states in America, Georgia and north Carolina.

This measure doesn’t account for other industries depending on forestry resources, like paper mills and wood products mills. Some areas have large available forestry area but low pellet production intensity. They may be candidates for new wood pellet export capacity.

In all areas, the first batch of wood pellet factories have the best combination of raw material delivery cost and mill-to-port logistics, while new factories don't have these advantages. Their cost of raw materials and logistic is higher than existing factories. Compared with America and Canada, Vietnam don't have large areas of potential forestry.

What’s the future of wood pellet export in Vietnam?

With more wood pellet plants are built in Vietnam, their competition on raw materials will increase. With the increase of production cost, the wood pellet price will grow and approach the global market equilibrium price. At that time, the size of the Vietnam pellet export sector will stabilize.

There will be consolidation in Vietnam wood pellet industry. Preponderant manufacturers will acquire well-built and well-located plants, and the less competitive plants will close.

Newly built wood pellet plants will adopt world-class design, equipment, and operations. They will make high-quality wood pellets with sustainable resources.

The capacity of Vietnam wood pellet producers is going to match with long-term agreements. More producers will export wood pellets to Japan according to long-term supply agreements, and Korea policy will evolve to support long-term supply agreements.

We receive enquiries in English, Español (Spanish), Русский язык (Russian), Français (French) and العربية (Arabic). Our professional team will reply to you within one business day. Please feel free to contact us!